2016-08-25

By: Advocate Brokerage

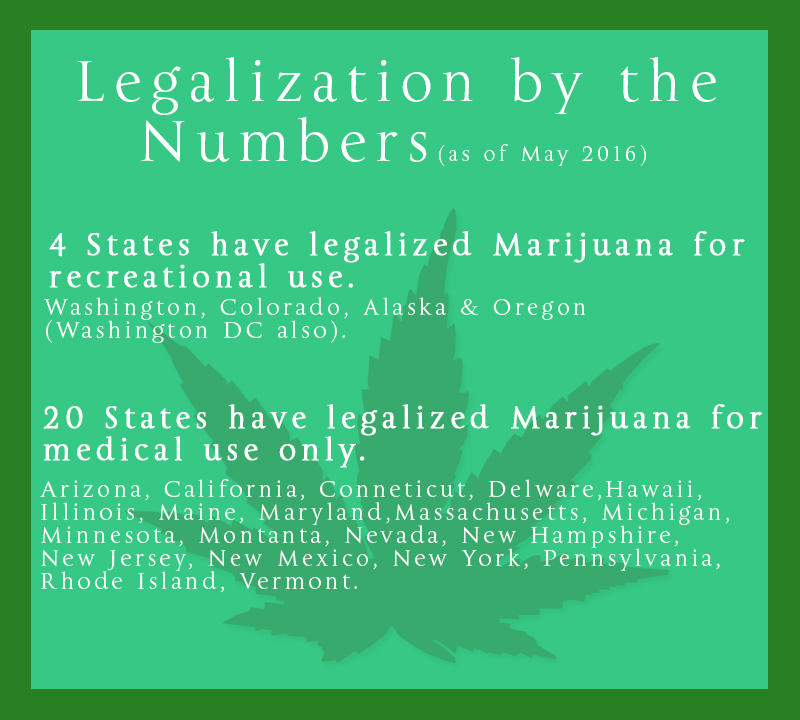

Since 2012, when states throughout the US began to legalize the use of Marijuana, the insurance industry has been monitoring the potential added risks the new laws could bring.

For Businesses

The use of marijuana while on the job can have a negative effect on your insurance premiums and policies. If your employees come to work while under the influence and an incident occurs, several things can occur:

Advocate’s Advice to Business Owners: Make sure you have a strict corporate drug use policy in place.

If you don’t allow the use of alcohol then the same rules should apply to the use of marijuana. Aside from the potential risks, studies have proven that the use of marijuana has the potential to decrease productivity. Plus, some carriers offer premium credits to business owners who establish a drug-free work place so, it is worth taking steps to create that that type of environment.